Call Calendar Spread

Call Calendar Spread - They are most profitable when the underlying asset does not change much until after the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Calendar spreads allow traders to construct a trade that minimizes the effects of time. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. See examples of long calendar.

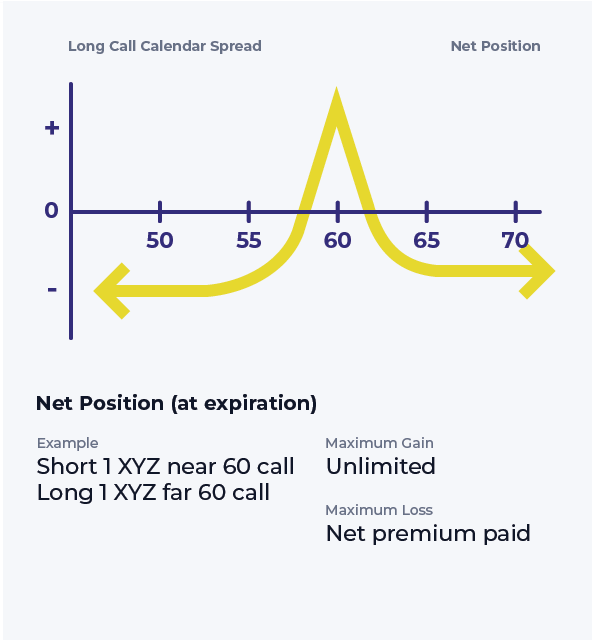

Long Call Calendar Spread Options Strategy

They are most profitable when the underlying asset does not change much until after the. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to.

Calendar Spread Options Trading Strategy In Python

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. See examples of long calendar. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one.

Trading Guide on Calendar Call Spread AALAP

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. A calendar spread is an option trade that involves buying and.

How to Trade Options Calendar Spreads (Visuals and Examples)

See examples of long calendar. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Entering into a calendar spread simply.

Long Call Calendar Spread Explained (Options Trading Strategies For

They are most profitable when the underlying asset does not change much until after the. See examples of long calendar. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or.

Calendar Spread Options Examples Mavra Sibella

Calendar spreads allow traders to construct a trade that minimizes the effects of time. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. See examples of long calendar. They are most profitable when the underlying asset does not change much until after.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. See examples of long calendar. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for.

Calendar Call Spread Strategy

Calendar spreads allow traders to construct a trade that minimizes the effects of time. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage.

Calendar Call Spread Option Strategy Heida Kristan

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. They are most profitable when the underlying asset does not change much until after the. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take.

Calendar Call Spread Strategy

Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. They are most profitable when the underlying asset does not change much until after the. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to.

See examples of long calendar. They are most profitable when the underlying asset does not change much until after the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Calls With The Purchased Call Expiring One Month Later.

They are most profitable when the underlying asset does not change much until after the. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

See Examples Of Long Calendar.

Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)