Calendar Call Spread

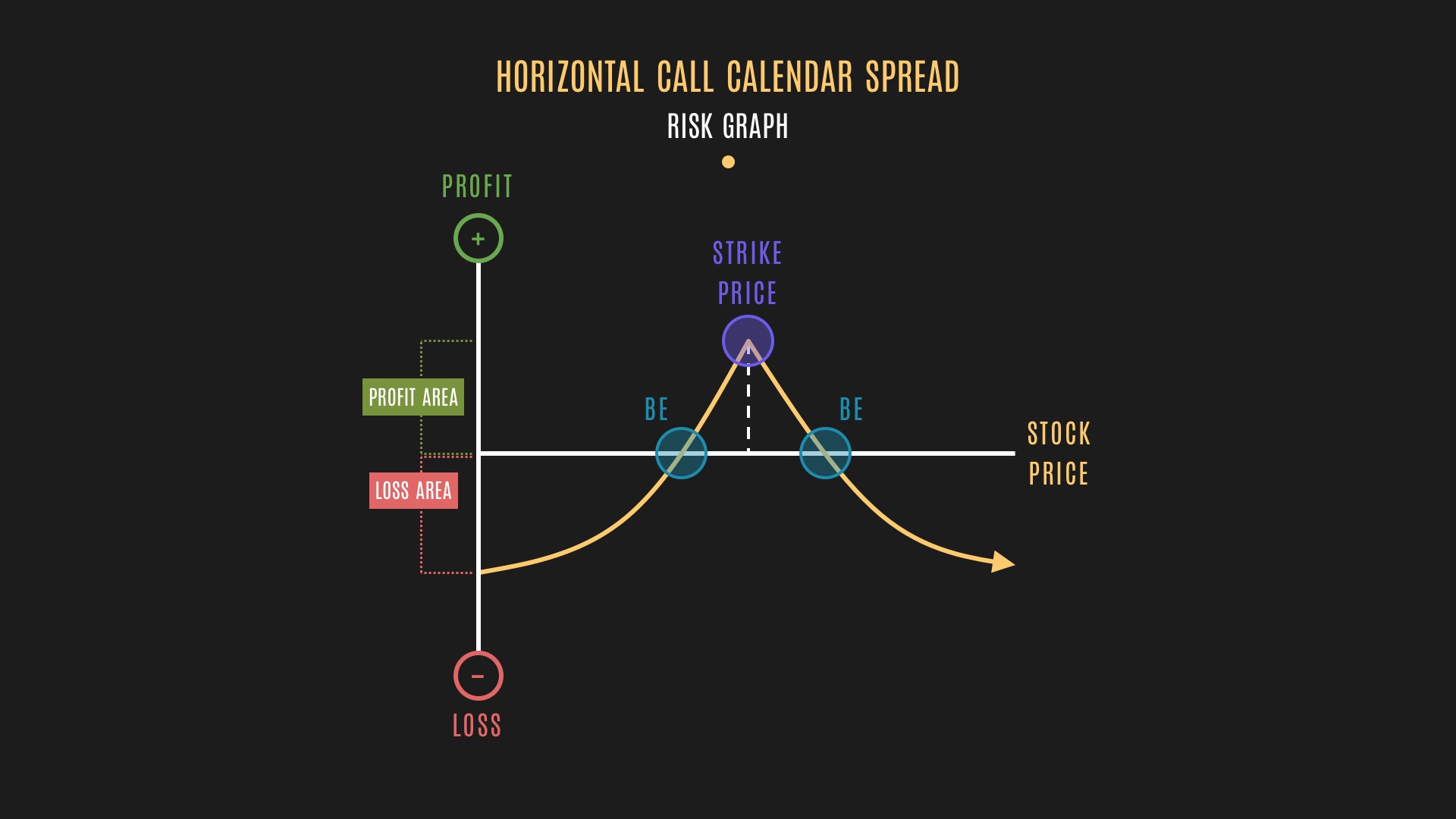

Calendar Call Spread - Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk. A calendar spread involves buying and selling options with different expiration dates to profit from time decay and neutral price movement. Find out the setup, strategy, tips, and. Find out the benefits, risks, and tools for this market neutral strategy. Learn how a calendar spread works and how implied volatility affects its profit potential. Learn what a calendar spread is, how it works, and how to trade it. See examples of long calendar spreads for calls and puts, and how to plan and manage the trade. Learn how to use calendar spreads with options and futures to profit from time decay and volatility. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

Long Calendar Spreads Unofficed

Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk. Find out the benefits, risks, and tools for this market neutral strategy. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. See examples of.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Find out the key components,. Learn how a calendar spread works and how implied volatility affects its profit potential. Compare long and short call and put calendar spreads with examples and advantages. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Find out the benefits, risks,.

Calendar Call Spread Mella Siobhan

Compare long and short call and put calendar spreads with examples and advantages. Find out the setup, strategy, tips, and. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. A calendar spread involves buying and selling options with different expiration dates to profit from time decay.

Calendar Call Spread Strategy prntbl.concejomunicipaldechinu.gov.co

Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Learn how to use calendar spreads to profit from different levels.

Calendar Call Option Spread [SPX] YouTube

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Find out the key components,. Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk. Learn how a calendar spread.

Calendar Spread Kiah Selene

Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk. Learn what a calendar spread is, how it works, and how to trade it. Compare long and short call and put calendar spreads with examples and advantages. A calendar spread is an option trade that involves buying.

Call Spread Profit Calculator CALCULATORVGW

Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Compare long and short call and put calendar spreads with examples and advantages. A calendar spread involves buying and selling options with different expiration dates to profit from time decay and neutral price movement..

Calendar Call Definition, Purpose, Advantages, and Disadvantages

Compare long and short call and put calendar spreads with examples and advantages. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Find out the benefits, risks, and tools for this market neutral strategy. Learn how a calendar spread works and how implied.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Find out the benefits, risks, and tools for this market neutral strategy. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. A calendar spread involves buying and selling options with different expiration dates to profit from time decay and neutral price movement. Learn how to use.

CALENDARSPREAD Simpler Trading

Compare long and short call and put calendar spreads with examples and advantages. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. See examples of long calendar spreads for calls and puts, and how to plan and manage the trade. A calendar.

Learn how to use calendar spreads with options and futures to profit from time decay and volatility. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. A calendar spread involves buying and selling options with different expiration dates to profit from time decay and neutral price movement. Compare long and short call and put calendar spreads with examples and advantages. Find out the benefits, risks, and tools for this market neutral strategy. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how a calendar spread works and how implied volatility affects its profit potential. Learn what a calendar spread is, how it works, and how to trade it. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Find out the setup, strategy, tips, and. Find out the key components,. See examples of long calendar spreads for calls and puts, and how to plan and manage the trade. Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk.

See Examples Of Long Calendar Spreads For Calls And Puts, And How To Plan And Manage The Trade.

Learn how a calendar spread works and how implied volatility affects its profit potential. Find out the setup, strategy, tips, and. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Learn how to use calendar spreads with options and futures to profit from time decay and volatility.

Learn How To Run A Calendar Spread With Calls, Selling And Buying Options With The Same Strike Price But Different Expiration Dates.

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Learn what a calendar spread is, how it works, and how to trade it. Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. A calendar spread involves buying and selling options with different expiration dates to profit from time decay and neutral price movement.

Find Out The Benefits, Risks, And Tools For This Market Neutral Strategy.

Compare long and short call and put calendar spreads with examples and advantages. Find out the key components,. Learn how to use calendar spreads to profit from different levels of volatility and time decay in the underlying stock, with limited risk.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)

![Calendar Call Option Spread [SPX] YouTube](https://i2.wp.com/i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)